Non Profit Invoice Template

Some accounting programs can also help you put together a profit and loss statement. The tax invoice must also show.

An invoice may contain tax details that is kept track of by the government.

. Accrual basic accounting is an accounting method that records revenues and expenses when an invoice is sent out regardless of when the payment is paid or received. Its quick accurate and highly effective and gets your invoice into the NDIA queue faster. Because non-profit organizations are exempt from tax it does.

If you are planning to run a Non-Profit Organisation you need a well-thought budget plan for your business. Goodwill Industries of Northern New England. Taxable and non-taxable sales.

Items are non-taxable if they are GST-free or input-taxed. This form documents the goods or services sold how many the price per unit and the total amount due. The proposal intends to provide information about the concerns which the non profit organization sees and their focus on addressing this matter as a form of a business or project.

The Profit and Loss template will enable you to set up your companys name and enter sales expenses dates and categories. Here are 8 Export Invoice Examples Templates that can be easily edited to suit your business as required. This Non Profit Business Proposal PDF template is your quick pitch letter to send to a potential or prospected grantor proposing business plan in order for the said business or project to be funded by a grantor.

The Profit and Loss statement template is easy to set up and use. The first paragraph in the body of your non-profit donation letter must specifically give an idea about the purpose of the letter. Our template pack includes editable invoice templates for limited companies and sole.

Yes if their deduction for all noncash gifts is more than 500. Understanding Form 990. This article explains how to make an invoice but what about getting an invoice example you can use straight away.

Write details about the activity where the donations will be used the date of the activity the information about your nonprofit organization and other major details that you would like the reader to know. Those who have donated non-cash items and items less than 250 may wonder if there is a specific tax donation form to use. Sample 501c3 Donation Receipt DONATION RECEIPT.

FormSwifts profit and loss statement template is created for business owners who need to easily create the document and do not have access to a program generated option. An export invoice is a reminder to the customer that shows the amount payable to the seller. It also lists the date by which the invoice should be paid.

An invoice is addressed to the buyer but also includes the sellers information. Non-Profit budget can be prepared for different purposes such as for development project fund-raising program business plan or grants. How To Claim a Tax Deduction With Charitable Donations.

Any business needs a budget plan even for a non-profit organization. There are five sales and fifteen expenses. It is essential for you to provide a statement that you.

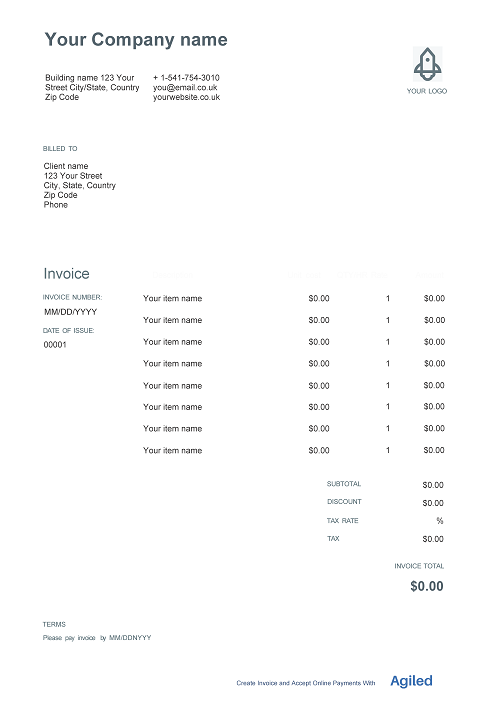

Yes must be listed to confirm the entitys non-profit status. An invoice template is used for quickly and easily creating an invoice when a sale of a service or good is completed. Download your free invoice template.

The template is also known as an Income Statement. Individuals and companies need to pay taxes every year using complex forms but non-profits do not. GSTR 20131 Goods and services tax.

Using this format will help ensure your invoices are claimed. Below youll find a pack of four invoice templates that you can use to create your own professional invoices. Name of the Non-Profit Organization.

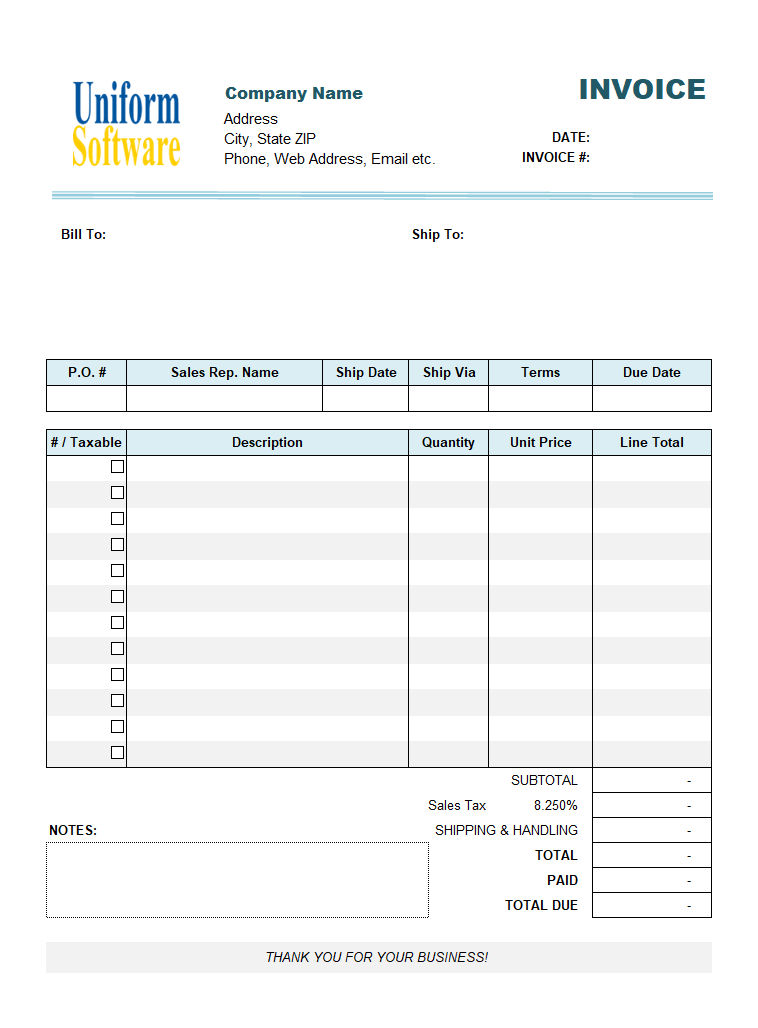

Were often asked by providers for an invoice template you can download the template here. Individuals partnerships and corporations should use Form 8283 to report information about noncash. A tax invoice that includes taxable and non-taxable items must clearly show which items are taxable.

If youre currently using hand-written or non-system generated invoices we can help. Tax invoices sets out the information requirements for a tax invoice in more detail. It is a legal document between the customer and the buyer.

It is suitable for both individuals and Limited companies. The statement On Publication 78 Data List. A profit and loss statement can be prepared by the owner of the company or the accountant.

Free Non Profit Invoice Template Agiled Edit And Send

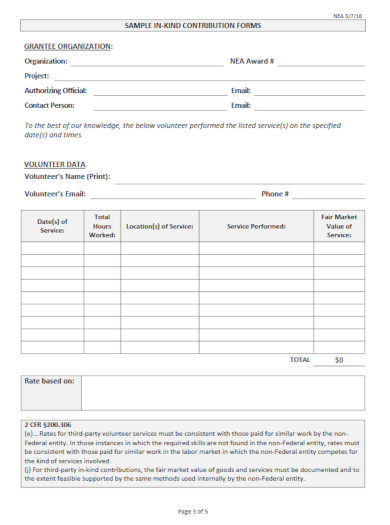

10 Non Profit Invoice Templates Pdf Psd Google Docs Word Free Premium Templates

10 Non Profit Invoice Templates Pdf Psd Google Docs Word Free Premium Templates

Free Non Profit Invoice Template Agiled Edit And Send

Non Profit Invoice Template Free Downloadable Templates Freshbooks

Free Simple Non Profit Organization Invoice Template

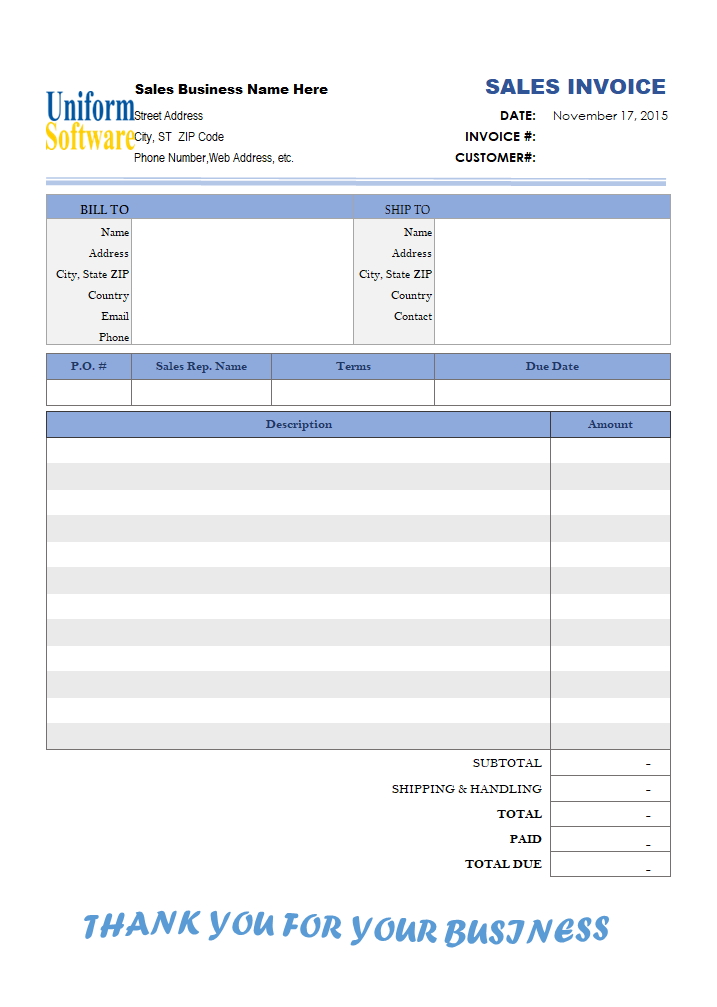

Non Profit Invoice Template Free Downloadable Templates Freshbooks

Non Profit Invoice Template Invoice Quickly Free Download

Posting Komentar

Posting Komentar